Market Update January 2023

In this January edition of our Market Update, we review the major events of 2022 and take a look at the year ahead.

A look back:

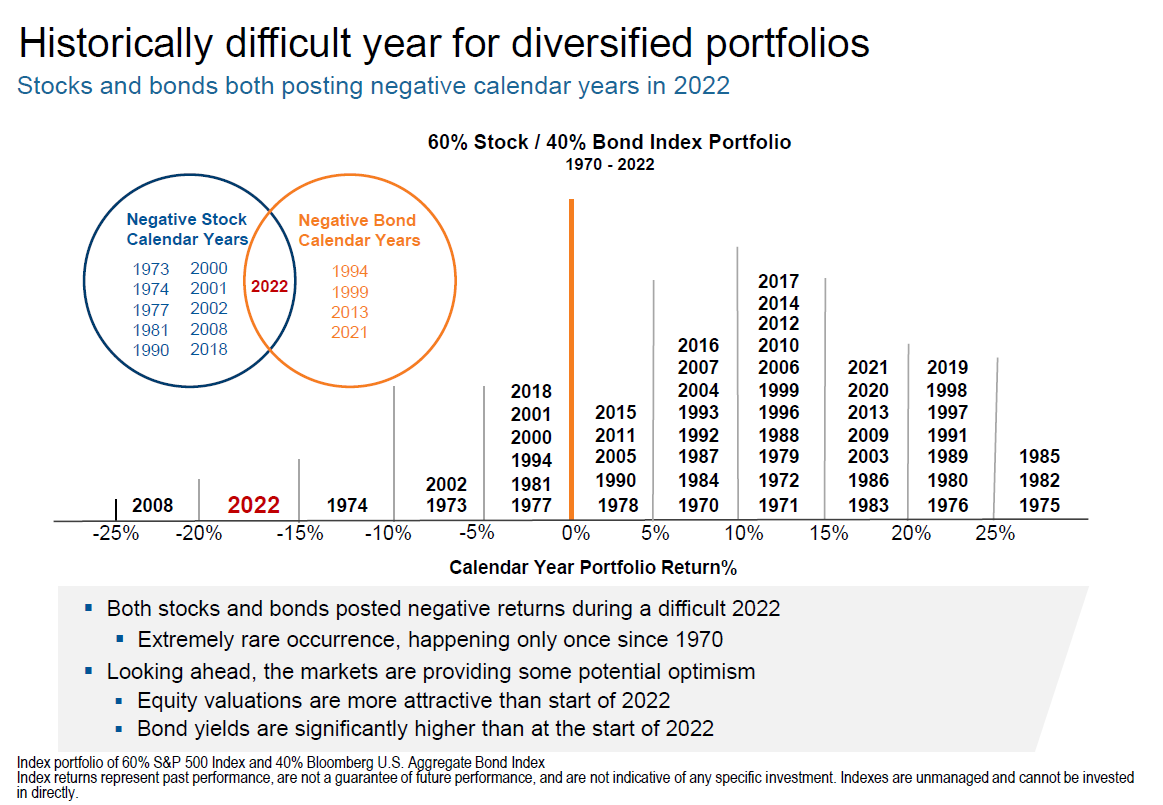

After a tumultuous year in the markets, 2022 has proven to be a challenging one for investors. Global stocks and bonds posted losses, with the former down 18% and the latter 16% (see graph below). The cause of this downturn was a perfect storm of events that began in 2021 with major disruptions in global supply chains due to COVID-19, followed by the Russian invasion of Ukraine which pushed food and energy prices to record highs. This led to economic overheating and a tight labour market, resulting in inflation we haven’t seen since the 1970s. In response, central banks around the world quickly shifted to increasing interest rates, pressuring equity and bond markets as well as the real estate sector.

What’s ahead for 2023:

Going forward, a faster-than-expected slowdown in inflation would represent the most optimistic scenario provided it prompts central banks to stop or even reverse their cycle of rate hikes sooner than anticipated and thus avoid a recession. That said, excessive monetary tightening (increasing interest rates) by the Federal Reserve is still a risk factor and one that we continue to closely monitor.

As such, we remain cautiously optimistic going into 2023 and are committed to the three pillars of our investing style - protect what you have (preserve capital), invest for income, and achieve a reasonable rate of growth over time.

As always, if you have any questions or would like to discuss please feel free to contact us.

P.S. The graph below illustrates the impact of a perfect storm on global stocks and bonds.