Market Update July 2023

As you look over your quarterly reports, you will notice that a significant shift occurred in our international exposure throughout 2021 and early 2022. The turning tide in the Fed's stance, their movement towards an interest rate hiking cycle to tackle inflation, and ever-looming geopolitical risks prompted us to step back from international exposure. However, we have done a lot of work in the last few months researching the best way to regain international exposure for a few reasons.

Let us explain why:

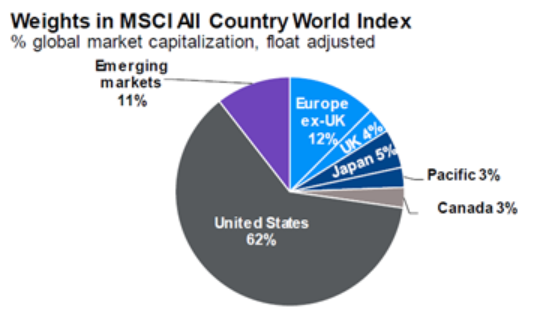

As Canadians we are often predisposed to a "home bias", investing the bulk of our assets within Canada, a nation representing merely 3% of the global economy. The strength of our markets is primarily made up of resources, financial services and industrials. By branching out into international markets, we're diversifying into high-quality multinational businesses, always with an eye on dividend growth.

When comparing apples to apples, international equities currently offer more appealing valuations than their US counterparts. We are particularly attracted to European and Japanese equities, where we've allocated most of our international exposure.

Despite this, we recognize the persistence of certain market risks and ambiguities. Hence, we are gradually building our international exposure, portioning out our investments until we reach our full desired allocation. As you can see from the chart below Canada only represents 3% of the Market cap and it’s vital that we invest internationally.

Source: FactSet, Federal Reserve, MSCI, Standard Poor’s, J.P. MorganAssetManagement. All return values are MSCI Gross Index data.15-year history based on USD returns.15-year return and beta figures are calculated for the time period 12/31/2007 to 12/31/2022.

Our preferred instrument, the “NBI International High Conviction Private Portfolio”, is a managed concentrated portfolio of approximately 30+ stocks that mirror our investment philosophy, concentrating on a prime selection of dividend-yielding companies.

Looking ahead, our focus in the next three months will be on vigilantly managing portfolio risks, leveraging the present high interest rates by incorporating low-risk investments into your portfolio. The financial landscape is rife with uncertainty, from the US debt ceiling to the stubborn inflation that keeps central banks in a tightening cycle, to regional instability and geopolitical conflicts - shall I go on? But don’t worry, we're on top of it.

Our conviction in fixed income remains strong, as yields are at their highest in over a decade. Commodities, especially gold, traditionally flourish in higher interest rate environments and we plan to maintain our stance here.

As for the much-anticipated recession, rest assured that we are closely monitoring for any signs. Our portfolio is well-equipped to handle this, and we're ready to adjust our strategy if circumstances dictate.

Interestingly, the current US market rally is largely driven by the big seven tech stocks, which contributed to 110% of the year-to-date performance. Given that value stocks usually thrive in high-interest environments, we anticipate a pullback in the tech space as the market digests tech overvaluations, reminiscent of the 2000s.

To ease your mind we wanted to share this in-depth guide to broad market and economic trends backed with data as of June 30, 2023, that explores and debunks commonly held investment beliefs vs the reality of having a strong stable portfolio that is consistently and carefully managed. Click here to download the Flip Book pdf.

In these times of persistent uncertainty and volatility, we hold firm to our three pillars of investing: managing risk, preserving capital, and generating steady income. Our unwavering commitment to these principles will guide us through these unpredictable times.