Ukraine and Your Silverbirch Portfolio

We are posting and sharing this letter sent to our clients to provide them with some comfort and assurance regarding their portfolios as the worst-case scenario of a Russian attack on Ukraine is now a sad reality.

Global markets had not been pricing in a war scenario and are now adjusting to the magnitude of the military move and further countermoves by the rest of the world through economic sanctions. This devastating world event will not impact your portfolio as much as the news media might lead you to believe. Media of every type from social to traditional is reporting as this tragic situation unfolds building more uncertainty in the markets by the hour. It is crucial to remember that the media is reporting on the world and how the investment markets will adjust as a whole, they are not reporting on your portfolio and how it is structured for these events.

We have been through many of these types of events before (our team has over 80 years of experience) and, as with the beginning of the pandemic, we were already prepared.

First, we have been working hard to ensure we are not impacted by geopolitical issues. Already at around 15-20% cash in client portfolios (depending on your risk tolerance) having sold investments in Europe and the US in early December, approximately 30-40% of the portfolio is invested in fixed income. This means about 45-60% of the portfolio is in safe, stable investments. Our current portfolio structure generates about 2.5-3% income yield. We also currently hold a 2.5% position in gold to protect the portfolio in these times of uncertainty.

Current equity held in the portfolio is ~40% of the total, well below where we would typically be and our exposure to the US and Europe is limited to only ~15% of the portfolio, with Canada representing 20% of the total.

Second, the way we invest is typically far less volatile than what would be understood if one simply watched the performance of stock market indices. We invest in companies that are profitable, not those that are speculative. Our Canadian stock exposure should do well given Canada is a direct competitor to Russia and Ukraine in many of the resources they have and sell. More importantly, regarding our US holdings, the exposure that we have to the US market is far less volatile than the reported indices. For example, since we sold a portion of our US position, it is down only ~3% versus the S&P 500 being down ~11% in the same period. When we do invest, we do so where there is less volatility and a greater likelihood of protecting principal.

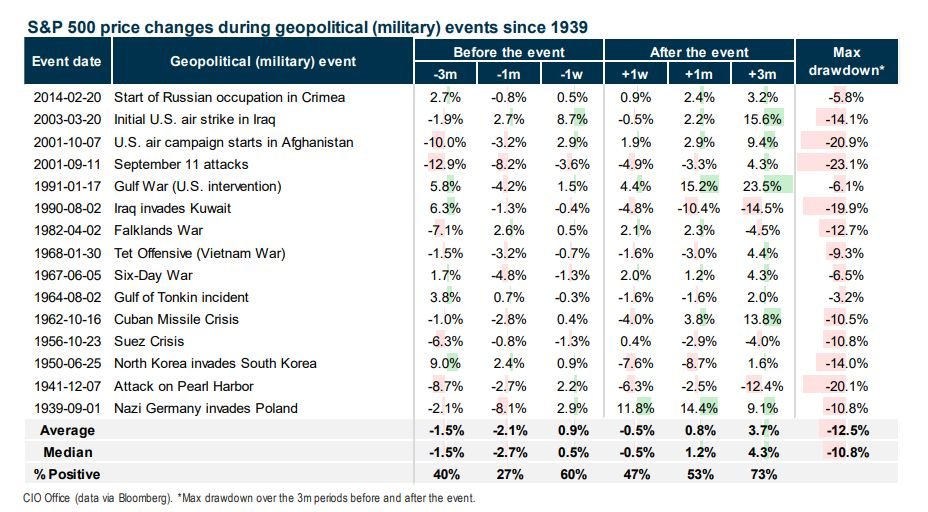

For historic context, our NBF strategy team went back eight decades to observe how stock markets behaved in times of military conflict. Since these events rarely occur without warning, they included the months preceding each of these heightened tensions.

Finally, we follow an intentionally rigorous process for when to rebalance, when to reduce exposures and when to add back. The key is that we typically are never completely out of the market as these events can start and end quickly. The most difficult thing to do in investing is to pick tops and bottoms. We need to stay invested to a certain level. If we wait until it’s ‘safe’ to pick bottoms in investment markets, the markets will have moved higher than when we sold. In the meantime, however, we earn income to offset any drop that may occur. This particular situation can turn on a dime either way.

We continue to follow our three pillars of investing:

Preservation of Capital

Income to protect and provide for clients’ needs

Achieve a reasonable rate of growth

We are monitoring this situation closely and will make changes as needed, though most of the work has already been done. We will take advantage of any excessive market volatility by using the cash to invest in the market as needed.

If you have any questions or need anything please click here to send us a note. The appropriate team member will respond promptly. Please remember we are always here for you.